How It Works

We run your

service operations, so you can focus on growth and performance

How It Works

We run your service operations, so you can focus on growth and performance

End-to-end client services

With Lyra operating as your behind-the-scenes client services team.

We deliver seamless onboarding, investor servicing, and third-party coordination under your brand, with our precision. Lyra doesn’t replace your investor relationships; we protect and enhance them. Our white-labelled service model means your clients stay connected to you, while we do the work that scales.

End-to-end client services

With Lyra operating as your behind-the-scenes client services team.

We deliver seamless onboarding, investor servicing, and third-party coordination under your brand, with our precision. Lyra doesn’t replace your investor relationships; we protect and enhance them. Our white-labelled service model means your clients stay connected to you, while we do the work that scales.

End-to-end client services

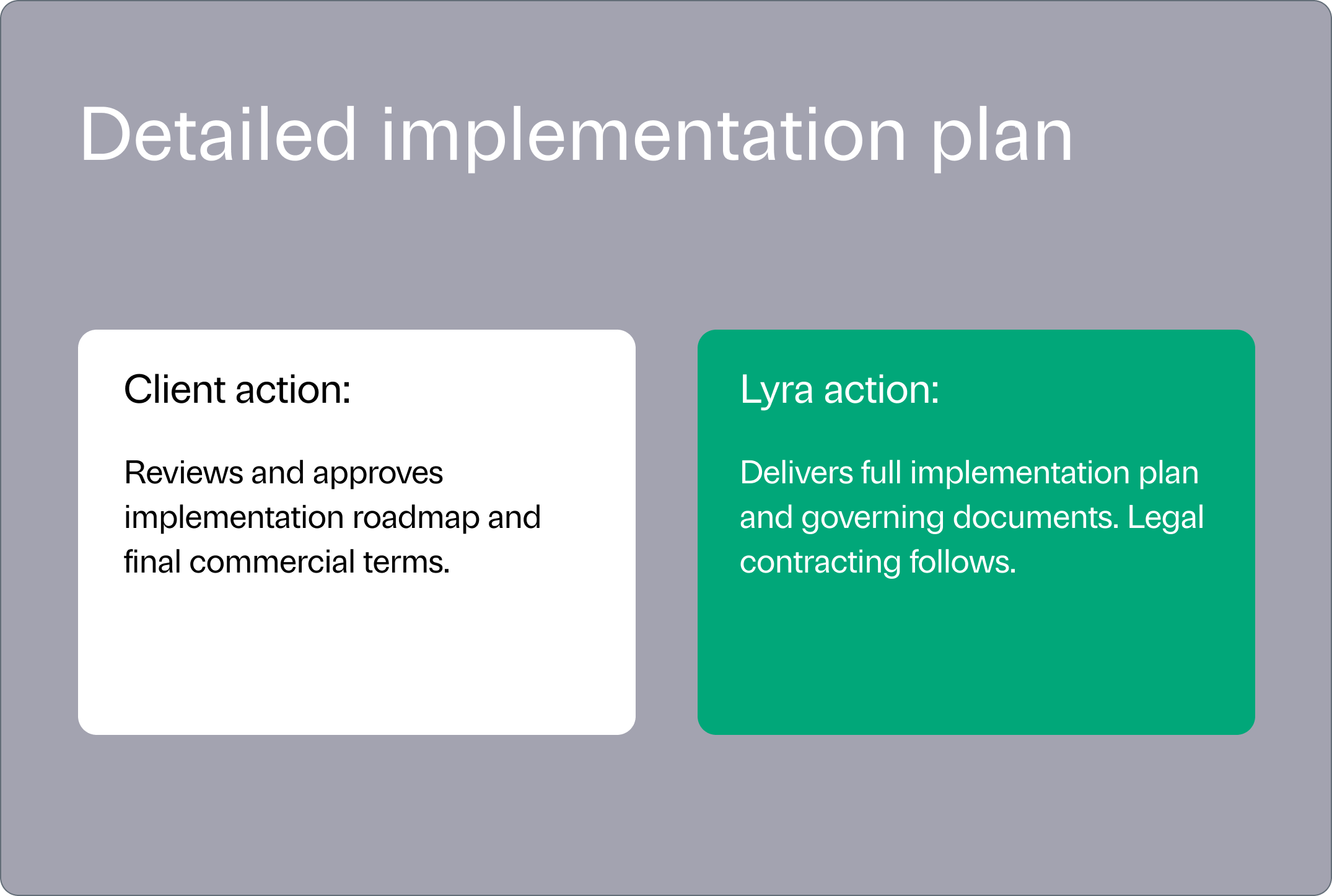

We engage from day one, combining clear onboarding with smart integration and fast setup—balancing your input with focused Lyra execution.

We engage from day one, combining clear onboarding with smart integration and fast setup—balancing your input with focused Lyra execution.

End-to-end client services

Technology, built for performance

Vega

Fund transparency and lifecycle intelligence. A real-time dashboard for performance tracking, reporting, and investor communications—built to strengthen decision-making and the investor experience.

Daphne

Digital onboarding and compliance for alternative investments. Streamlines KYC/AML, subscription documents, and investor due diligence—built to support seamless fund entry at scale.

Corastone

Integration layer for fund administration in alternatives. Simplifies capital calls, investor notifications, and data flows across administrators and custodians—reducing manual overhead and risk.

We work with a connected suite of platforms.

Each technology partner plays a specific role on streamlining operations and improving the client experience.

Technology, built for performance

We work with a connected suite of platforms.

Each technology partner plays a specific role on streamlining operations and improving the client experience.

Vega

Fund transparency and lifecycle intelligence. A real-time dashboard for performance tracking, reporting, and investor communications—built to strengthen decision-making and the investor experience.

Daphne

Digital onboarding and compliance for alternative investments. Streamlines KYC/AML, subscription documents, and investor due diligence—built to support seamless fund entry at scale.

Corastone

Integration layer for fund administration in alternatives. Simplifies capital calls, investor notifications, and data flows across administrators and custodians—reducing manual overhead and risk.

Our model is built for flexibility, integrating smoothly with your systems or new tools as your needs evolve

Our model is built for flexibility, integrating smoothly with your systems or new tools as your needs evolve

FAQ

-

Lyra is a technology-enabled client servicing platform designed to support alternative asset managers in scaling investor relationships, streamlining operations, and delivering high-quality service. It combines human expertise with modern tools to create a new benchmark for private markets service.

-

Lyra aims to become the leading client servicing platform for private markets—offering institutional-grade support that meets the rising expectations of investors, wealth managers, and fund managers alike.

-

Unlock Fee-Related Earnings (FRE) uplift by enhancing client servicing margins

Scale without increasing headcount through operational leverage

Improve investor experience to drive retention and growth

Build foundational infrastructure that supports long-term innovation

-

Lyra works with a variety of fund types and investor models. Flexibility is built in, and where needed, we collaborate to shape workflows that suit your setup.

-

Lyra supports a range of investor types, with onboarding and servicing workflows aligned to each group—ensuring the right level of support and communication from day one.

-

Lyra helps you scale by centralizing operations, reducing manual work, and streamlining investor interactions—freeing your team to focus on growth.

-

Yes. The Lyra team is tech enabled but we support manual processes too, managing subscriptions across formats to ensure accuracy and access for every investor.

FAQ

-

Lyra is a technology-enabled client servicing platform designed to support alternative asset managers in scaling investor relationships, streamlining operations, and delivering high-quality service. It combines human expertise with modern tools to create a new benchmark for private markets service.

-

Lyra aims to become the leading client servicing platform for private markets—offering institutional-grade support that meets the rising expectations of investors, wealth managers, and fund managers alike.

-

Unlock Fee-Related Earnings (FRE) uplift by enhancing client servicing margins

Scale without increasing headcount through operational leverage

Improve investor experience to drive retention and growth

Build foundational infrastructure that supports long-term innovation

-

Lyra works with a variety of fund types and investor models. Flexibility is built in, and where needed, we collaborate to shape workflows that suit your setup.

-

Lyra supports a range of investor types, with onboarding and servicing workflows aligned to each group—ensuring the right level of support and communication from day one.

-

Lyra helps you scale by centralizing operations, reducing manual work, and streamlining investor interactions—freeing your team to focus on growth.

-

Yes. The Lyra team is tech enabled but we support manual processes too, managing subscriptions across formats to ensure accuracy and access for every investor.

Do you have specific business needs?

Reach out to our team and discover how Lyra can unlock value for your firm.

Let’s connect

Let’s connect

Do you have specific business needs?

Reach out to our team and discover how Lyra can unlock value for your firm.